VERY EXCITING! Orion Lending now welcomes AVERAGED Mid-Scores for Conventional loans with more than 1 borrower & NO MIN CREDIT SCORE! What does that mean?? It means you can now use the income/assets for <620 borrowers to help qualify more buyers!

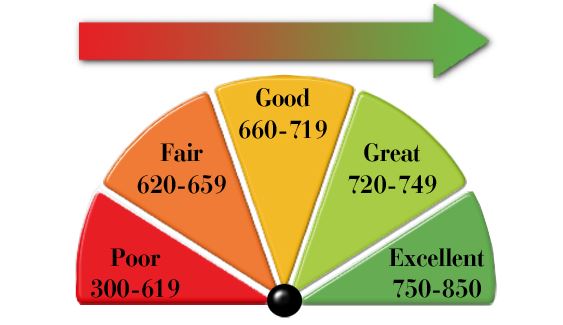

Example: You have a 560 mid-score borrower and a 760 mid-score borrower, DU will use an average the 2 mid scores (660 average), and as long as you get an Approve/Eligible, we are good to go! (You’ll still use the lower mid-score for registration and pricing, but pricing is actually not too shabby!)

Notes:

- Use the Average mid-score of all borrowers to run DU

- Use the mid-score of the lowest score borrower for Registration and Pricing. Our STAR Portal will now accept FICO scores below 620.

- No Minimum FICO score for individual borrowers!

- For loan casefiles with more than one borrower, DU will use an average median credit score when determining if a loan casefile meets the minimum credit score requirement of 620.

- AUS must return Approve/Eligible Findings. Manual underwritten loans are not acceptable.

- Loan pricing and Mortgage Insurance will be based on the representative FICO score, the lowest middle FICO of all borrowers.

- The Average Median FICO is NOT eligible for FNMA RefiNow loans.